Arkansas Rice Update 7-3-25

Arkansas Rice Update 2025-16

July 3, 2025

Jarrod Hardke, Scott Stiles, Camila Nicolli, & Nick Bateman

“I’ve been through the desert on a horse with no name.”

Firecracker Rice

Overheard this week: “stretch pants and math are two things that don’t lie.”

The comment was in reference to the current agriculture situation and the math not working.

Now, spend months griping about the rain only to be begging for a little help from a rain. Just an average Arkansas summer. Isolated storms have certainly helped some in their irrigation efforts over the last two weeks, but much of the Delta is running on all cylinders trying to keep up with this heat and the rapidly advancing crop.

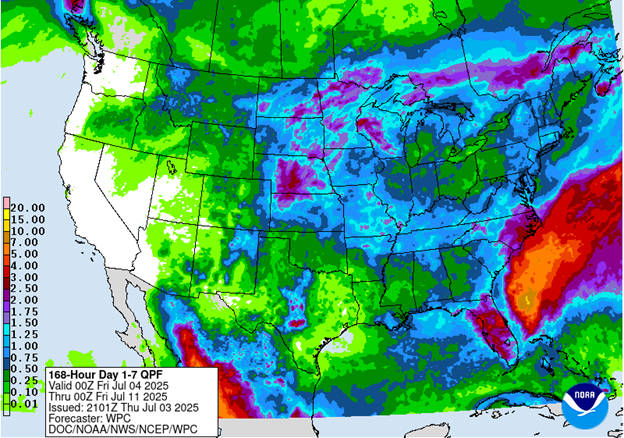

Little relief is expected in the next 7 days (Fig. 1). But there are chances throughout next week, so we can hope that some of that does turn into meaningful help. As usual, the help may also hurt some as conditions that improve our irrigation efforts also improve conditions for disease issues.

More on this topic below, but acres were lowered in the Acreage report this week – just not as much as I thought. By the time we see the first FSA certified acres reported in August, I’m still expecting lower than what was in Monday’s report.

Read on below for more information on midseason and boot nitrogen, fungicide application timing, rice stink bug control, rice markets, and the Acreage report.

Let us know if we can help.

Fig. 1. NOAA 7-day precipitation forecast.

Ricing Around

Jarrod Hardke

-

Early planted rice (March) has some odd growth progress showing out at this time that’s worth noting. In some instances main tillers are trying to head out while secondary tillers are much further behind. Early season flooding clearly separated the maturity of these tillers. Even in some fields where flooding was less of an issue but management was delayed, some of the same strange progress can be observed. The best advice is to manage the majority of the field – if only 10% of tillers are advanced, make management decisions based on the rest of the field, not those early tillers. This will be crucial for getting the most out of fungicide and insecticide applications.

-

We also still have rice at a point to receive midseason nitrogen (N). For varieties, wait at least 21 days after preflood N was incorporated before applying midseason N – preferably wait 28 days. Stop worrying so much about what joint movement (internode elongation) is. Rice needs time to take up and use preflood N – if it’s not finished with it, it’s not going to take up midseason N. For rice that was fertilized late to begin with, 21 days may end up being enough time to be ready for midseason, but if preflood went out somewhat on time, I’m looking for 28 days to apply midseason. I do want midseason to be applied prior to late boot (flag leaf collar visible). Vegetative growth stages have shortened over time in our effort to have earlier maturing varieties, so it makes sense that we will find ourselves a little further into reproductive growth before rice is finished with preflood N to be ready for midseason N uptake.

-

Hybrids and boot N: we covered this last week, but our data continues to show an economic benefit to the application. It provides several small increases that add up to something meaningful (yield + milling + standability). 65 lb urea (30 lb N) is all you need. Additional N beyond this rate has not shown an added benefit. Here’s some additional data if you’re into that sort of thing.

Table 1. Hybrid response to late boot nitrogen (N) applications at three locations in 2023.

Hybrid and Location |

30 lb N/acre @ Late Boot |

No Late Boot N |

||

|---|---|---|---|---|

|

|

Yield (bu/ac) |

Head Rice-Total Rice (%) |

Yield (bu/ac) |

Head Rice-Total Rice (%) |

|

RT 7302 @ Keiser |

248 |

55/69 |

235 |

53/69 |

|

RT 7302 @ Pine Tree |

232 |

48/69 |

222 |

45/68 |

|

RT 7302 @ Stuttgart |

220 |

60/71 |

203 |

59/70 |

|

RT 7421 FP @ Keiser |

250 |

52/67 |

244 |

49/68 |

|

RT 7421 FP @ Pine Tree |

211 |

45/67 |

204 |

45/67 |

|

RT 7421 FP @ Stuttgart |

183 |

53/69 |

180 |

55/70 |

|

RT 7321 FP @ Keiser |

225 |

47/67 |

207 |

47/68 |

|

RT 7321 FP @ Pine Tree |

219 |

46/69 |

203 |

42/69 |

|

RT 7321 FP @ Stuttgart |

181 |

56/70 |

173 |

54/70 |

At Stuttgart and Pine Tree, 120 lb N/acre preflood N rate was used. At Keiser, 150 lb N/acre preflood N rate was used.

Fungicide Application Timing in Rice by Target Disease

Camilla Nicolli

What Disease Management Should You Focus on Right Now in Arkansas Rice?

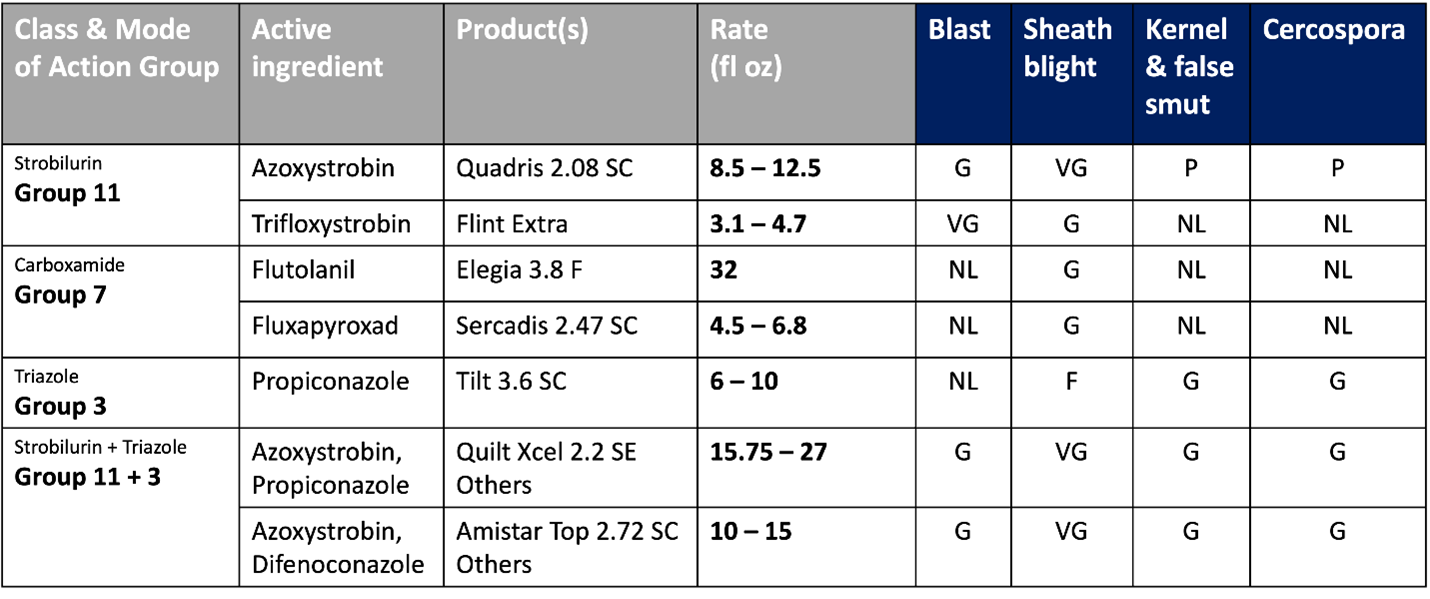

After a very rainy season, many rice fields across the state are now ranging from panicle differentiation to approaching boot and heading stages. This is a critical window for disease management, and it’s important to stay ahead.

Below is a fungicide application timing chart by rice disease to help guide chemical treatment decisions (Table 2). Looking at the upcoming weather forecast – 35-40% chance of rain from Tuesday through Saturday, with consistent temperatures between 74-92 F – the risk of sheath blight is expected to increase.

We strongly encourage growers to actively scout their fields using a zigzag pattern, avoid field edges and low bottoms, to make timely and effective fungicide application decisions (https://arkansascrops.uada.edu/posts/disease/scout-rice-blight.aspx).

Stay vigilant and protect your crop during this critical stage!

Table 2. Fungicide Timing by Disease and Rice Growth Stage.

Disease |

Scout? |

Fungicide available |

PD+7 days |

Early boot |

Mid-Boot |

Late Boot |

Up to 10% Head out |

50-75 % Head out |

After heading |

|---|---|---|---|---|---|---|---|---|---|

|

Rice Blast |

Yes |

yes |

- |

- |

- |

✓✓ Recommended |

✓✓ Recommended |

✓✓ Recommended |

✗ Late |

|

Sheath Blight |

Yes |

yes |

✓ If needed |

✓ If needed |

✓✓ Recommended |

✓✓ Recommended |

✓ If needed |

✓ If needed |

? Check pre-harvest interval |

|

Cercospora (NBLS) |

No |

yes |

- |

✓✓ Recommended |

✓✓ Recommended |

✓✓ Recommended |

✗ Late |

✗ Late |

✗ Late |

|

False Smut |

No |

yes |

- |

✓✓ Recommended |

✓✓ Recommended |

✗ Late |

✗ Late |

✗ Late |

✗ Late |

|

Kernel Smut |

No |

yes |

- |

✓✓ Recommended |

✓✓ Recommended |

✗ Late |

✗ Late |

✗ Late |

✗ Late |

Fig. 2. What Fungicide Should I Use?

P = poor; F = Fair; G = good; VG = very good; NL = not labeled for use against that

disease.

Rice Stink Bug Management in 2025-Options and Economics

Nick Bateman

As some of our earliest rice has begun heading in the past week, it’s time to talk about what our options are for this year. Some of the fields we have been in are averaging 15-20 rice stink bugs per 10 sweeps with a few calls of much higher numbers. We expect these numbers to most likely decrease over the next week or two after more rice heads.

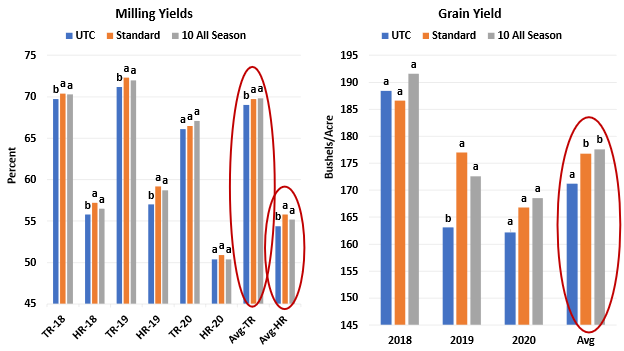

The biggest change in management this year is with the threshold. We have moved the threshold to 10 bugs per 10 sweeps throughout the whole year, instead of the 5 per 10 during the first two weeks and 10 per 10 during the second two weeks. We have been evaluating this threshold since 2017 and all our data suggest that we can go to a straight 10 all season without jeopardizing yield or quality losses (Fig. 3). Lastly on thresholds, let fields get to a minimum of 75% headed before making applications. If using products such as Tenchu, we want to get as much product on heads as possible to increase odds of residual control.

**DO NOT add an insecticide to your fungicide application prior to heading. We actually see an increase in stink bug numbers following these applications due to killing of beneficial insects.**

We are still seeing marginal control of rice stink bug with lambda-cyhalothrin and frankly it is not something we would rely on. Tenchu is our only currently labeled reliable product. It has performed well in our studies in recent years (Table 3) and has provided better economic returns than pyrethroids. While we have heard from multiple folks that money is tight and they can’t afford the Tenchu price tag, we also cannot afford not to spray rice stink bugs when they exceed threshold. On average we gained $24.00/ac when using Tenchu compared to not spraying at all and actually lost money when using pyrethroids. These economics were figured on state average yields, so the price increase will only go up as the yield potential goes up.

At this point I think it is a given, but lambda is not providing the control it once did and if you are going to use it, you need to know that 50-60% control is about the best it is going to do. If this fits your situation then it’s still the cheapest and most readily available option, just realize there is essentially no residual, and the control is pretty poor and gets worse the later into the season we go.

There is another dinotefuran (Tenchu) option this year made by Sharda called Kruger. It is formulated the same as Tenchu but currently we have no data on this product.

One way to get the “most bang for your buck” with Tenchu is to spray during the 2nd or 3rd week of heading (when heads just being to turn down). It has the residual to get us to our termination timing of 60% straw-colored kernels. Our current situation doesn’t really allow the flexibility to spray twice with Tenchu, so as mentioned above, if we have numbers of 10 per 10 sweeps or less during the first two week of heading, keep the product in the jug and apply once we start moving into soft dough. The one consistent thing we have seen is the quality losses associated with above threshold populations of rice stink bug during the second two weeks of heading and it can get costly.

The last thing we want to mention is the current status of Endigo ZCX. We have been receiving calls since this winter on whether we would be getting another section 18 this year or not. Currently there is a large quantity of Tenchu available, and EPA is aware of it. Until this runs out, we have no legal justification to submit. We can assure you that if/when stocks run out, we are fully prepared to submit for a crisis exemption. Time will tell. Call us if you have any questions.

Fig. 3. Milling yield and grain yields for multiple rice stink bug threshold studies conducted throughout Arkansas (2018-2020).

Table 3. Economics for multiple foliar insecticides for control of RSB based on grain quality assessments.

|

|

TOT Cost of App |

Grade** |

Grade Discount |

Head Rice |

Total Rice |

Net Returns |

ROI*** |

|---|---|---|---|---|---|---|---|

Insecticide |

$/ac |

|

$/ac per cwt |

% |

% |

$/ac |

$/ac |

|

UTC |

$0.00 |

3.5 a |

$ 0.09 |

57.8 c |

67.5 b |

$1177 b |

|

|

Warrior II 1.82 oz* |

$13.65 |

2.9 b |

$ 0.06 |

58.0 b |

67.8 b |

$1176 b |

$ -1.58 b |

|

Mustang Maxx 4 oz |

$12.85 |

2.9 b |

$ 0.06 |

58.2 b |

67.6 c |

$1174 b |

$ -3.16 b |

|

Tenchu 8oz |

$20.72 |

1.9 c |

$ 0.01 |

59.8 a |

68.9 a |

$1201 a |

$ 24.00 a |

|

p-value |

|

<0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

|

*Lambda-Cyhalothrin (Silencer, Kendo, Lambda-Cy, ect.) **Grades were determined based on peck percentage ***Return on investment |

|||||||

Market Update

Scott Stiles

As a reminder, there will be no ag futures trading Thursday evening or for the entire day Friday, July 4th. Trading will resume at 7:00 pm central time on Sunday evening like normal.

Following what could be considered a “friendly” June 30 Acreage report, the rice market continues to get pounded in the ground. The September contract closed 15 ½ cents lower after Monday’s USDA reports and another 5 ½ cents lower Tuesday. Recall though, the downturn in the rice market started last week. This week’s action is just a continuation of a correction that was already underway. The September contract now trades below all its major moving averages and has completed a 62% retracement (and then some) of the move from $12.53 to the recent high at $13.92 ½. Near term support is at $12.90.

Fig. 4. CME September 2025 Rough Rice Futures, Daily Chart.

Monday’s Acreage report wasn’t a big surprise to the rice market and certainly not bearish. The table below summarizes the state and U.S. long-grain acreage changes from NASS’ March and June surveys. For reference, NASS conducted their June Acreage survey from May 30th and June 16th.

Note the 210,000-acre reduction from March to June. Arkansas accounts for 180,000 acres of the total decline. Mississippi and Missouri both shed 20,000 acres each since the March survey. Louisiana added 10,000 acres.

Table 4. U.S. Long-Grain Rice Acres Planted, 2025. |

||||

|---|---|---|---|---|

State |

USDAMarch 31 |

USDAJune 30 |

change(000) acres |

% change |

|

Arkansas |

1.320 |

1.140 |

-0.180 |

-14% |

|

California |

0.010 |

0.010 |

0.000 |

0% |

|

Louisiana |

0.410 |

0.420 |

0.010 |

2% |

|

Mississippi |

0.150 |

0.130 |

-0.020 |

-13% |

|

Missouri |

0.210 |

0.190 |

-0.020 |

-10% |

|

Texas |

0.140 |

0.140 |

0.000 |

0% |

|

U.S. Total |

2.240 |

2.030 |

-0.210 |

-9% |

|

source: USDA, National Agricultural Statistics Service, June 2025 |

||||

The results of NASS’ June Acreage puts U.S. and Arkansas long-grain acreage at the lowest since 2022. That year, Arkansas had 1 million acres of long-grain. For now, these are the acres that will be plugged into the July 11th WASDE. In August, FSA will release its’ first round of certified acres. NASS will compare notes with FSA and make future acreage revisions as necessary.

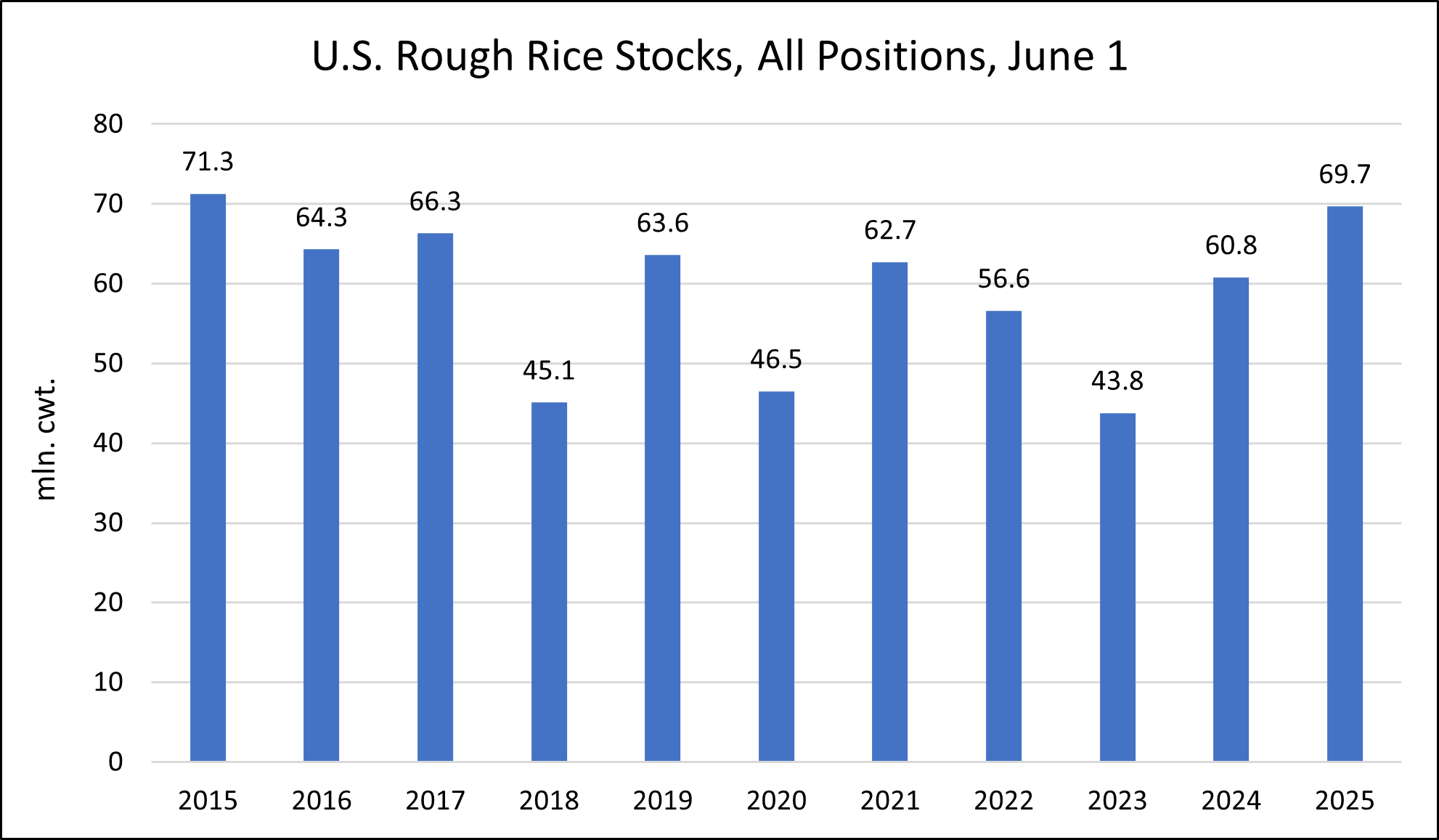

In addition to the Acreage report, USDA also released its’ quarterly Rice Stocks report on Monday. Quite possibly it was the most bearish news for the rice market. Oftentimes it’s the stocks reports that hold the biggest surprises, because of their difficulty in estimating.

Rough rice stocks as of June 1 were “heavy” compared to previous years. NASS noted rough rice stocks in all positions (on-farm and commercial) on June 1, 2025 totaled 69.7 million hundredweight (cwt), up 15 percent from the total on June 1, 2024. Stocks held on farms totaled 10.4 million cwt and off-farm stocks totaled 59.3 million cwt.

Fig. 5. U.S. Rough Rice Stocks, all positions, June 1.

The U.S. on-farm stocks of 10.4 million cwt. were almost double the June 1 total last year of 5.37 million. As of June 1, Arkansas growers had 7.35 million cwt. of rice sitting in on-farm storage compared to 3.1 million a year ago. At 7.35 million, that would be the highest in the last 18 years.

It will be interesting to see if the revelations in the June 1 stocks lead USDA to make some old crop demand adjustments. If quarterly stocks are surprisingly high, it can mean that old crop production was actually higher than current estimates or the current estimate of domestic usage is too high. USDA will likely wait for the September Rice Stocks before making revisions to 2024 production, if needed. The size of the June 1 stocks may indicate something is out of line with usage. If so, USDA may dial down old crop demand in next week’s WASDE.

Ending on a more positive note, the findings in the June Acreage will be incorporated into the July WASDE. We know that USDA will be using long-grain harvested acreage of 2.01 million. The big question today is “what yield will they use?” given the wide planting window this year. Using an estimated yield of 7,539 pounds, that could theoretically pull long-grain production down to 151.5 million cwt. compared to 159.7 million cwt. in June. Purely a guess at this point. A significant portion of any production cut will generally be offset somewhat by lower demand. In summary, we should see another downward revision in long-grain production in the July WASDE. This may provide not only support to new crop futures, but a reversal in the recent downtrend.

Happy 4th of July.

DD50 Rice Management Program is Live

The DD50 Rice Management Program is live and ready for fields to be enrolled for the 2025 season. All log-in and producer information has been retained from the 2024 season, so if you used the program last year you can log in just as you did last year. Log in and enroll fields here: https://dd50.uada.edu.

Use the Arkansas Rice Advisor Internet App!

The Arkansas Rice Advisor site https://riceadvisor.uada.edu functions like an app on your mobile device. There you can readily access the DD50 program, rice seeding rate calculator, drill calibration, fertilizer and N rate calculators, publications, and more.

Additional Information

Arkansas Rice Updates are published periodically to provide timely information and recommendations for rice production in Arkansas. If you would like to be added to this email list, please send your request to rice@uada.edu.

This information will also be posted to the Arkansas Row Crops blog (http://www.arkansas-crops.com/) where additional information from Extension specialists can be found.

More information on rice production, including access to all publications and reports, can be found at http://www.uaex.uada.edu/rice.

Acknowledgements

We sincerely appreciate the support for this publication provided by the rice farmers of Arkansas and administered by the Arkansas Rice Research and Promotion Board.

The authors greatly appreciate the feedback and contributions of all growers, county agents, consultants, and rice industry stakeholders.

Specialist |

Area |

Phone Number |

|

|---|---|---|---|

|

Jarrod Hardke |

Rice Extension Agronomist |

501-772-1714 |

|

|

Tom Barber |

Extension Weed Scientist |

501-944-0549 |

|

|

Nick Bateman |

Extension Entomologist |

870-456-8486 |

|

|

Ralph Mazzanti |

Rice Verification Coordinator |

870-659-5507 |

|

|

Camila Nicolli |

Extension Pathologist |

608-622-2734 |

|

|

Trent Roberts |

Extension Soil Fertility |

479-935-6546 |

|

|

Bob Scott |

Extension Weed Scientist |

501-837-0273 |