Arkansas Rice Update 5-16-25

Arkansas Rice Update 2025-09

May 16, 2025

Jarrod Hardke, Scott Stiles, Bob Scott, & Trent Roberts

“Ain’t that a kick in the head.”

Can’t Get Right

Problem season is in full swing. The weather started it and it seems determined to finish it. The forecast for this week was supposed to be for little rain, warmer temps, and an increase in sunshine. Some got less rain but too many got surprise rains, temps did warm, but sunshine was elusive for all but one day. Not the recipe we hoped for. The warmer temps do have rice on the move, but without any sunlight it doesn’t want to look any better.

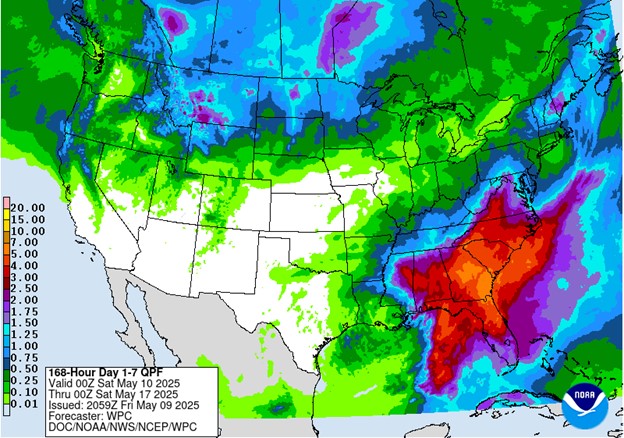

The weather forecast for the next several days isn’t any better, which isn’t big news, just more of the same (Fig. 1). Last year it seemed like the rains had it out for southeast AR, this year it’s northeast AR (and central AR variable both years). The added twist is now a cooldown toward the end of next week with highs back into the 70s and lows into the 50s.

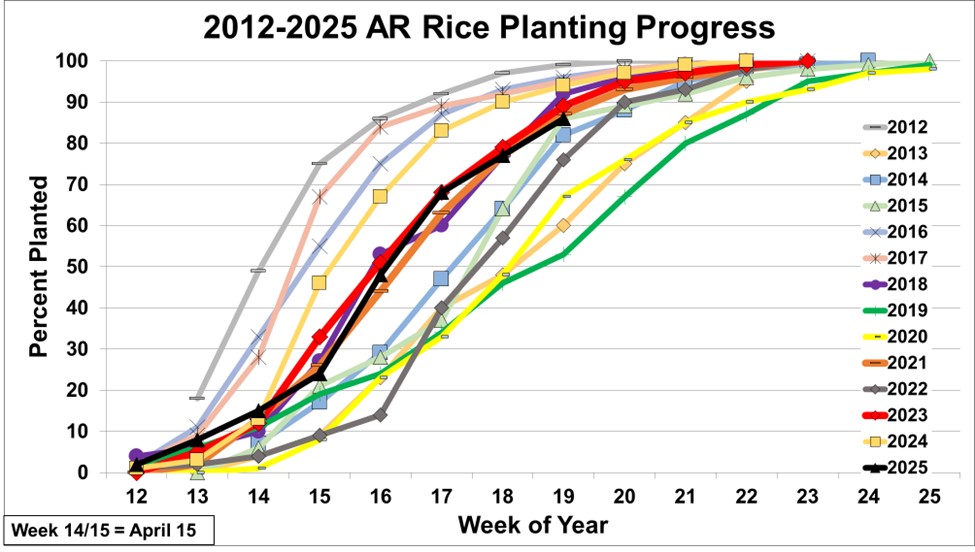

Spotty planting progress (Fig. 2) should have us over 90% planted as we waterski toward the May 25th prevented planting date. We’re entering the window where continued rice planting can still be successful, but our confidence in the yield outcomes falters. Planting in the latter half of May we begin to depend on late summer / early fall weather a great deal to determine what our yield will be – and considering our inability to predict tomorrow’s weather, guessing the weather months from now it like using a broken Magic 8-ball that always says “ask again later.”

It was mentioned last week to watch out for neighboring crops when making herbicide applications, and this week the herbicide injury calls have taken off. Use caution!

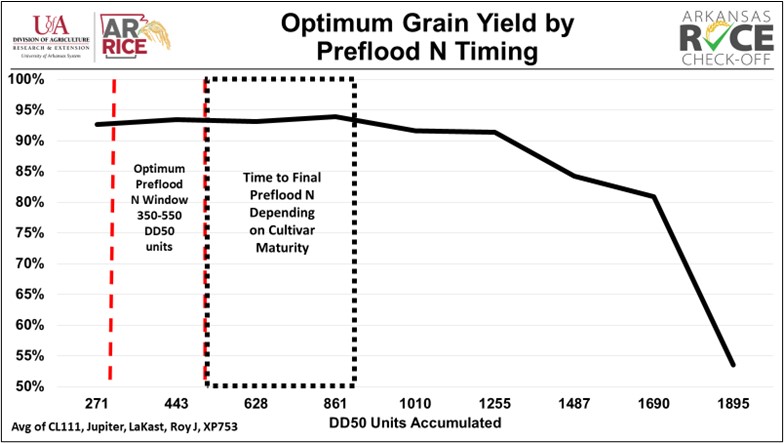

The earliest rice fields are beginning to reach the end of the optimal preflood nitrogen window. With suboptimal soil conditions, you still have time to wait for better conditions toward the final recommended preflood N timing before you punt to plan B. We’ll cover more on managing N under wet soil conditions next week if rains continue, but if you have questions in the meantime please call. Use the DD50 program to know where you stand!

Read on below for more information on preflood nitrogen for low stands, general nitrogen recommendations for flood and furrow rice, herbicide drift, and rice markets.

Let us know if we can help.

**DD50 Rice Management Program is live! To enroll fields: https://dd50.uada.edu/ **

Fig. 1. NOAA 7-day precipitation forecast.

Fig. 2. Arkansas rice planting progress as of 5-11-25 (USDA-NASS).

Preflood N Thoughts for Low Stand Densities

Jarrod Hardke

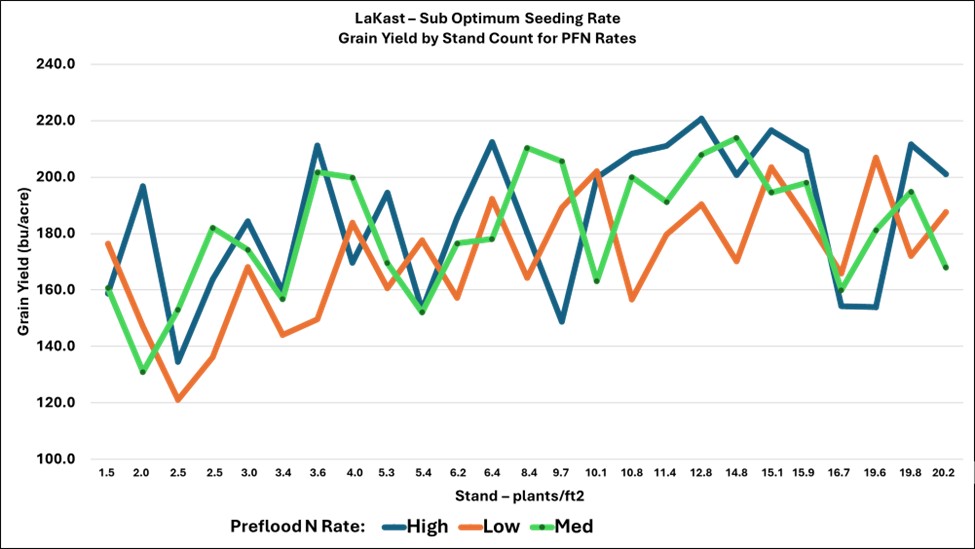

Now that we’ve progressed to the point we have kept fields with sub-optimal stands, let’s think about how we’re going to manage them to flood. The first thing to point out is that there is inconsistency in response to preflood nitrogen (PFN) rates when we have lower stands, because low stands are often erratic!

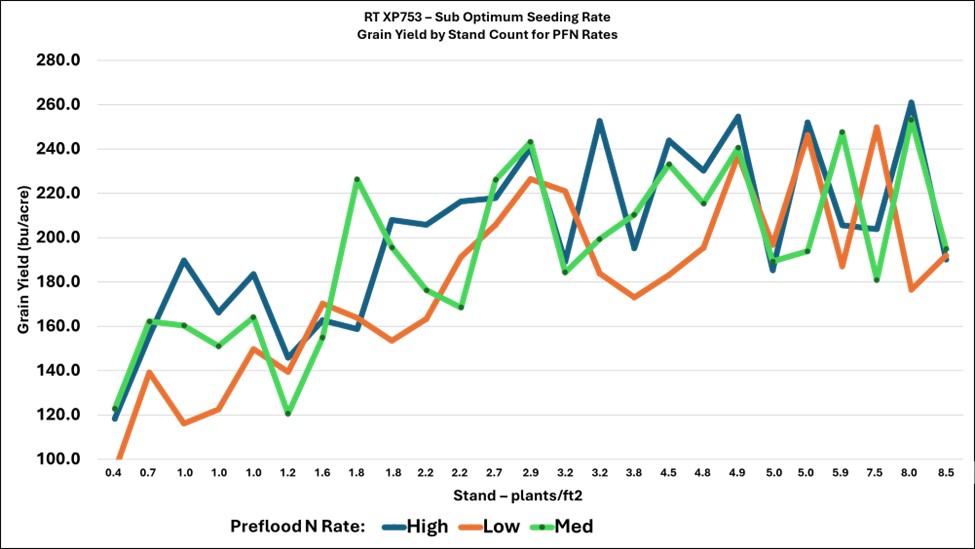

Several years ago, we put LaKast and XP753 through some trials where we deliberately planted very low seeding rates (compared to more recommended rates) and then used different PFN rates to see if we could improve our situation. Remember the yields shown here are from small plot work that can be elevated sometimes – focus on the trends rather than exact bushels.

Long story short, the data for LaKast (Fig. 3) shows that if we’re using medium (recommended) rates or above, we can see some yield improvement; but it may not be any big bump. The most important thing it shows to me is that you DO NOT reduce the PFN rate with low stands. I’ve had that question a lot over the years – I have less plants to take up N so I should need less N – NOPE. The figure decently depicts why we like keeping varieties with stands over 5 plants/ft2 as you see a steady yield trend down from there. Maintaining or slightly increasing the PFN rate can help push tillering to make up for lost plant stands. Although varieties cannot tiller to the same extent as hybrids, optimal or slightly increased PFN rates will make sure they take advantage of the extra “space” associated with low plant stands. One cause of the variable yield response with low plant stand is associated with “holes” in the field that cannot be overcome with tillering simply because there are no plants there.

For XP753 (Fig. 4), I would say we more often got some noticeable response out of pushing the PFN rate at lower stands. Echo the comment above about not lowering your N rate (lower N rate is lower yield). The figure also shows why we like to keep hybrid stands of 3 plants/ft2 or greater, and that things can fall off fairly quickly below that. Since hybrids have greater tillering capacities, we often see a yield increase with additional PFN as this can promote even more tillering in thin plant stands.

Recommendations:

For varieties with stands below 5 plants/ft2, consider increasing PFN by 10-20 lb N/acre. For stands over 5 but less than 10 plants/ft2, consider increasing PFN by 0-10 lb N/acre.

For hybrids with stands below 3 plants/ft2, consider increasing PFN by 10-20 lb N/acre. For stands over 3 but less than 5 plants/ft2, consider increasing PFN by 0-10 lb N/acre.

I believe that some of this response to increase in N is simply ensuring that adequate N is near all of our plants to maximize their yield potential. In thin stand situations this is critical. In normal, more uniform stands, the plants can compete for available N and maximize yield for you.

Fig. 3. Grain yield of LaKast at various stand densities and preflood nitrogen rates.

Fig. 4. Grain yield of RT XP753 at various stand densities and preflood nitrogen rates.

Pre-Irrigation Nitrogen Recommendations

Jarrod Hardke and Trent Roberts

Pre-irrigation – because we’re still kicking around 20% furrow-irrigated rice not everything is preflood.

So, let’s dive into some general comments really quick. The DD50 Rice Management Program is your friend – if you use it for nothing else then use it to guide your early nitrogen (N) management!

The data in Fig. 5 is from flooded data, but the point is valid regardless of how you’re growing rice in that we need to start feeding rice with N around / by the final recommended time for preflood N. You’re not falling off a cliff at that point, but the chances of a gradual decline in yield potential are possible and the cliff shows up later. Preflood N maximizes our tillering potential – our first yield component! Of note – pureline varieties are going to penalize you more, and faster, than hybrids if you’re late getting N out there to get the crop moving.

For flooded rice – N rate recommendations are in the Rice Management Guide. In general, most varieties have a 105 lb N/ac preflood and 45 lb N/ac midseason recommendation on a silt loam (preflood increases to 135 lb N/ac preflood on clay soil). Hybrids carry a standard recommendation of 120 lb N/ac preflood and 30 lb N/ac late boot (increase preflood to 150 lb N/ac on clay soils).

For furrow-irrigated rice things get a little more complicated.

Silt loam:

Hybrid – 3 apps of 100 lb urea every 7-10 days (+65 lb urea at late boot).

Variety – 4 apps of 100 lb urea every 7-10 days (the last app will align with midseason app).

Clay:

Hybrid – 165 lb urea followed by 165 lb urea 10-14 days later followed by 100 lb urea 7-10 days later (+65 urea at late boot) OR 4 apps of 100 lb urea every 7-10 days (+65 urea at late boot).

Variety – Minimum of 4 apps of 100 lb urea every 7-10 days (may need to consider a 5th app).

Fig. 5. Percent of optimum grain yield by preflood nitrogen timing (DD50 unit accumulation) for selected rice cultivars.

Bobbing and Weeding

Bob Scott

Tis the season for drift…

I hate it when the phone rings this time of year, there are certain numbers… you know who you are, that I am almost sure will be either difficult weed control questions or herbicide drift. I blame myself but I woke up last Friday and thought “man I have not had many drift calls.” Well, that changed this week. It has been a very challenging year for getting herbicides out. I can only think of a couple of days when the wind has not blown or that it has not rained.

Unfortunately, I spent the better part of this week fielding calls and looking at fields. Mostly glyphosate or Newpath on rice and a few calls of Highcard/Provisia on corn. See Fig. 6. I cannot overstate how sensitive conventional rice is to Newpath or Preface, the same goes for all rice types and their sensitivity to glyphosate. In many cases this year drift has gone completely across fields leaving very little patterns to follow. It is also not unusual to see damage on the tops of beds but not in the furrows in rice rice (both Newpath and glyphosate) (Fig. 7). This may be a bit controversial to say, but many times driving down the road I feel like I can pick out the conventional rice fields, I believe I would grow Clearfield/FullPage everywhere I could if I were a rice farmer, just to eliminate one issue.

I mentioned Highcard/Provisia or specifically the active ingredient, quizalofop, on corn. This is the same active ingredient that some of you may remember as Assure II, a graminicide or grass killer in soybean. It is the same chemistry group as Select, Fusilade, and Poast, if those names ring a bell. If you look at those labels, there are usually sections on using these products to control volunteer corn in soybean. Sometimes even at lower rates. I say all this to remind everyone how sensitive corn is to this product (quizalofop). We can see the same level of injury from Ricestar HT and Clincher, so just be careful out there.

Weed control wise I am running into another question as to what to recommend. I am getting lots of calls on annual sedge control (Fig. 8). This used to be an automatic Permit, Gambit type of answer or I might say don’t worry about it if it’s in Clearfield rice. Now I don’t know anymore. With all the resistance that we have out there it’s tough to ask a guy to apply a more expensive treatment like Basagran plus propanil, when I don’t know if it’s needed or not. If you consult, please take note of how well the ALS herbicides (Newpath, Permit, Gambit, League, etc.) work this year so we know what to spray next year.

Fig. 6. Provisia/Highcard on corn.

Fig. 7. Newpath drift affecting rice on bed tops and not furrows (left); and suspected glyphosate drift on rice (right).

Fig. 8. Annual sedge in rice.

Market Update

Scott Stiles

The week kicked off with USDA’s release of the May WASDE. Unfortunately, it contained very little good news for rice. The good news first. In the 2025/26 outlook for long-grain, USDA projects record usage of 208 million cwt. This was driven in large part by record domestic use of 140 million cwt. and 68 million cwt. in exports—up 3 million from 24/25. Using the March 31 acres from NASS, long-grain production is projected to be down 4.8 million cwt. from last year to 167.2 million.

The rice industry anxiously awaits the June 30 Acreage report for more clarity on 2025 production. The initial market reaction to Monday’s report was bearish. However, by Wednesday rice futures reversed higher on continued planting delays and prospects of lower final acres. In Friday’s session, September rice traded 50 cent/cwt. above the mid-week lows.

On to the bad news. The record usage for 25/26 is aggressive for certain and more than offset by the record total supply of 245.5 million cwt. On top of the 167.2 million cwt. crop that’s currently forecast, the new crop balance sheet has the added burden of a large 35.3 million carry-in from the 2024 crop. Also, record imports of 43 million cwt. are projected in the upcoming year.

The net result is ending stocks of 37.5 million cwt., which would be the highest seen since 1985. Heavy ending stocks will keep pressure on rice prices as USDA’s 2025/26 season-average farm price for long-grain is projected at $12.00 per cwt. or $5.40 per bushel. Furthermore, this initial price outlook points to a 2025 PLC payment of 90 cents per bushel; something we haven’t seen for long-grain since 2021.

Table 1. U.S. long-grain supply and demand.

unit: million cwt. |

2024/25 |

2025/26 |

y/y |

|---|---|---|---|

change |

|||

|

Beginning Stocks |

19.3 |

35.3 |

16.0 |

|

Production |

172 |

167.2 |

(4.8) |

|

Imports |

42 |

43.0* |

1.0 |

|

Total Supply |

233.3 |

245.5* |

12.2 |

|

Domestic Use |

133 |

140.0* |

7.0 |

|

Exports |

65 |

68.0 |

3.0 |

|

Total Use |

198 |

208.0* |

10.0 |

|

Ending Stocks |

35.3 |

37.5 |

2.2 |

|

stocks-use % |

17.8% |

18.0% |

|

|

Avg. Producer Price ($/cwt.) |

$ 14.20 |

$ 12.00 |

$ (2.20) |

|

Avg. Producer Price ($/bu.) |

$ 6.39 |

$ 5.40 |

$ (0.99) |

|

PLC Reference Price ($/bu.) |

$ 6.30 |

$ 6.30 |

|

|

Proj. PLC Payment Rate ($/bu.) |

$ - |

$ 0.90 |

|

|

* denotes record |

|

|

|

The global rice outlook for 2025/26 includes stable year-to-year ending stocks at 185.07 million tons. Production is forecast at a record 538.7 million tons, with increases expected for India and China. Production in India for 2025/26 is forecast at a 10th consecutive record. India is expected to surpass China again as the world’s largest rice producer and leading exporter at 24.0 million tons, or nearly 40 percent of global trade. Global rice consumption is projected at a record 538.8 million tons. USDA’s May WASDE report can be found here: May 2025 WASDE Report

Crop Progress:

In Monday’s Crop Progress, NASS reported U.S. rice planting was 80% complete as of May 11th and ahead of the 5-year average of 77 percent. The southern states can almost see the finish line. But, the last lap requires everyone wear muddy boots.

Table 2. U.S. rice planting progress.

State |

Week ending |

2020-2024 Average |

||

|---|---|---|---|---|

May 11,2024 |

May 4,2025 |

May 11,2025 |

||

|

|

(percent) |

(percent) |

(percent) |

(percent) |

|

Arkansas |

93 |

77 |

86 |

78 |

|

California |

29 |

35 |

40 |

52 |

|

Louisiana |

97 |

95 |

96 |

92 |

|

Mississippi |

81 |

74 |

80 |

76 |

|

Missouri |

86 |

59 |

77 |

69 |

|

Texas |

94 |

93 |

95 |

92 |

|

|

|

|

|

|

|

6 States |

83 |

73 |

80 |

77 |

|

Source: Crop Progress, USDA National Agricultural Statistics Service. |

||||

Planting the last few acres of rice has been a challenge to say the least. The elusive open week of dry weather would certainly help. As a reminder, the crop insurance Final Planting Date for rice in Arkansas is May 25th.

Chicago rice futures have continued to drift lower through planting while Urea prices have increased almost 30% over the past month. You could also throw in the fact soybeans got a favorable boost from the May WASDE and last weekend’s trade talks with China. The game pieces have moved so-to-speak as planting has dragged on. A review of crop budgets may be in order.

The University of Arkansas 2025 crop budgets were updated and re-posted on March 27th. Since then, fuel prices are slightly lower and Urea is considerably higher. Given these important input cost changes, take time to review crop budgets in making final planting decisions. The University of Arkansas crop budgets can be found here: 2025 Arkansas Crop Enterprise Budgets

DD50 Rice Management Program is Live

The DD50 Rice Management Program is live and ready for fields to be enrolled for the 2025 season. All log-in and producer information has been retained from the 2024 season, so if you used the program last year you can log in just as you did last year. Log in and enroll fields here: https://dd50.uada.edu.

Use the Arkansas Rice Advisor Internet App!

The Arkansas Rice Advisor site https://riceadvisor.uada.edu functions like an app on your mobile device. There you can readily access the DD50 program, rice seeding rate calculator, drill calibration, fertilizer and N rate calculators, publications, and more.

Additional Information

Arkansas Rice Updates are published periodically to provide timely information and recommendations for rice production in Arkansas. If you would like to be added to this email list, please send your request to rice@uada.edu.

This information will also be posted to the Arkansas Row Crops blog (http://www.arkansas-crops.com/) where additional information from Extension specialists can be found.

More information on rice production, including access to all publications and reports, can be found at http://www.uaex.uada.edu/rice.

Acknowledgements

We sincerely appreciate the support for this publication provided by the rice farmers of Arkansas and administered by the Arkansas Rice Research and Promotion Board.

The authors greatly appreciate the feedback and contributions of all growers, county agents, consultants, and rice industry stakeholders.

Specialist |

Area |

Phone Number |

|

|---|---|---|---|

|

Jarrod Hardke |

Rice Extension Agronomist |

501-772-1714 |

|

|

Tom Barber |

Extension Weed Scientist |

501-944-0549 |

|

|

Nick Bateman |

Extension Entomologist |

870-456-8486 |

|

|

Ralph Mazzanti |

Rice Verification Coordinator |

870-659-5507 |

|

|

Camila Nicolli |

Extension Pathologist |

870-830-2232 |

|

|

Trent Roberts |

Extension Soil Fertility |

479-935-6546 |

|

|

Bob Scott |

Extension Weed Scientist |

501-837-0273 |